Finance Management

Our Finance Management Module is a core component of an all-in-one business management system, enabling businesses to manage their financial activities efficiently and accurately. Here's a detailed overview of the key features of a robust Finance Management Module:

1. General Ledger

The general ledger serves as the backbone of the financial management module, allowing businesses to maintain detailed records of all financial transactions. It includes:

- A comprehensive chart of accounts

- Support for multiple currencies

- Flexible accounting periods and year-end processes

- Integrated journal entries for various types of transactions

2. Accounts Payable

This feature manages the process of paying vendors, suppliers, and other creditors. It provides tools for:

- Invoice processing and approvals

- Payment scheduling and tracking

- Management of vendor information and terms

- Reconciliation of accounts

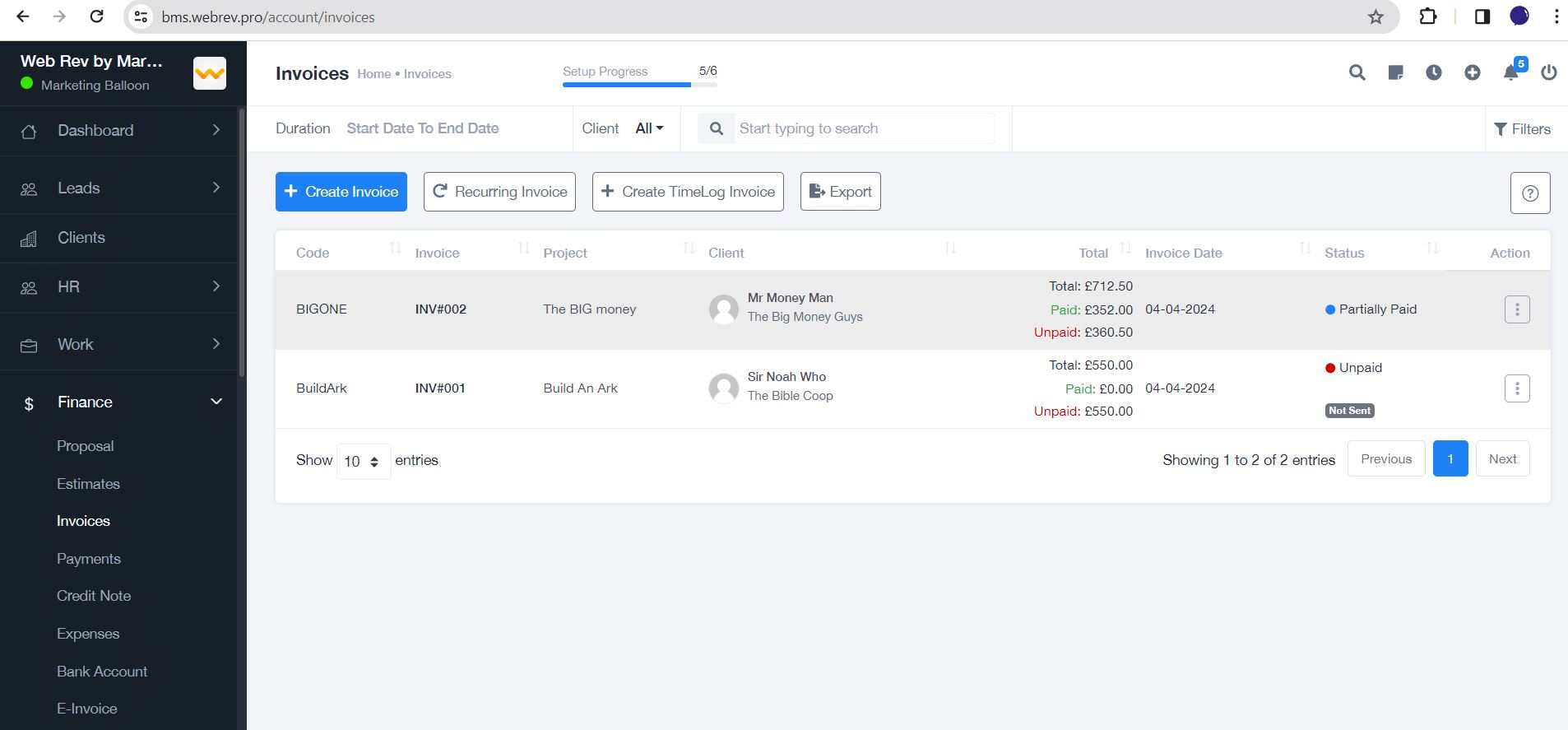

3. Accounts Receivable

The accounts receivable functionality helps manage customer billing and collections. It includes:

- Generation of invoices and credit memos

- Tracking of customer payments and outstanding balances

- Automatic reminders for overdue payments

- Integration with customer relationship management (CRM) systems for improved communication

4. Budgeting and Forecasting

This feature helps businesses plan their financial future. It provides:

- Tools for creating budgets and forecasts

- Integration with actual financial data for variance analysis

- Scenario planning and what-if analysis

- Customizable reporting for budget reviews

5. Financial Reporting and Analytics

Comprehensive financial reporting is critical for business insights and compliance. This feature offers:

- Standard financial reports (income statement, balance sheet, cash flow statement)

- Customizable report templates

- Real-time data visualization and dashboards

- Integration with business intelligence tools for advanced analytics

6. Cash Management

Effective cash management ensures liquidity and financial health. This module includes features such as:

- Bank account reconciliation

- Cash flow forecasting

- Integration with bank feeds for real-time updates

- Management of cash positions and transfers

7. Tax Management and Compliance

Staying compliant with tax regulations is essential. The tax management feature provides:

- Tools for calculating and filing taxes (sales tax, VAT, income tax, etc.)

- Support for multiple tax jurisdictions

- Generation of tax reports and audit trails

- Compliance monitoring and alerts

8. Asset Management

This feature tracks and manages a company's fixed assets, offering:

- Asset registration and categorization

- Depreciation calculations

- Asset lifecycle management (acquisition, maintenance, disposal)

- Integration with financial reports

9. Payroll Management

Payroll is an essential part of financial management. This feature allows businesses to manage payroll processes with:

- Employee payroll processing and calculations

- Integration with HR systems for employee data

- Automated tax withholding and filings

- Generation of pay stubs and payroll reports

10. Integration with Other Modules

A Finance Management Module should seamlessly integrate with other business functions, such as:

- Inventory management for accurate costing

- Customer relationship management for billing and collections

- Human resources for payroll and employee expenses

- Project management for tracking project costs and revenues

These features work together to provide a comprehensive solution for managing a company's finances. The Finance Management Module is designed to streamline financial operations, improve accuracy, and ensure compliance, ultimately contributing to a business's overall success and sustainability.